Building wealth often feels like a daunting task, especially when starting with limited funds. However, micro-investing has emerged as a game-changing solution, enabling everyday Australians to grow their wealth one small step at a time. By allowing users to invest spare change or make small contributions regularly, micro-investing platforms make the world of finance accessible to everyone. Whether you’re saving for a home deposit, a dream holiday, or retirement, micro-investing can be the first step in achieving your financial goals. This blog delves into the role of micro-investing in building wealth, its benefits, and how to get started in the Australian context.

1. What Is Micro-Investing?

Micro-investing involves making small, regular investments rather than committing large sums upfront. Platforms like Raiz and Spaceship have made micro-investing accessible to Australians by lowering entry barriers. With micro-investing, even spare change from everyday purchases can be rounded up and invested into diversified portfolios. This approach allows beginners to dip their toes into investing without the need for extensive knowledge or large amounts of capital.

Key Tip

Choose a platform that aligns with your financial goals and risk tolerance to maximise the benefits of micro-investing.

2. How Does Micro-Investing Work?

Micro-investing platforms typically work by automating the investment process. For example, Raiz rounds up your purchases to the nearest dollar and invests the difference. If you spend $4.50 on a coffee, $0.50 is added to your investment account. Over time, these small contributions add up, benefiting from compounding returns. Additionally, platforms often allow users to set recurring deposits or one-time investments, providing flexibility.

Key Tip

Link your micro-investing app to your everyday bank account for seamless automation.

3. Benefits of Micro-Investing

Accessibility

Micro-investing removes the intimidation factor of traditional investing. With low minimum investment amounts, anyone can start building wealth, regardless of income level.

Affordability

There’s no need for a large lump sum to begin investing. Micro-investing platforms cater to Australians who want to start small and grow steadily.

Compounding Growth

Small investments can lead to significant returns over time thanks to the power of compounding. Earnings are reinvested, generating additional returns.

Diversification

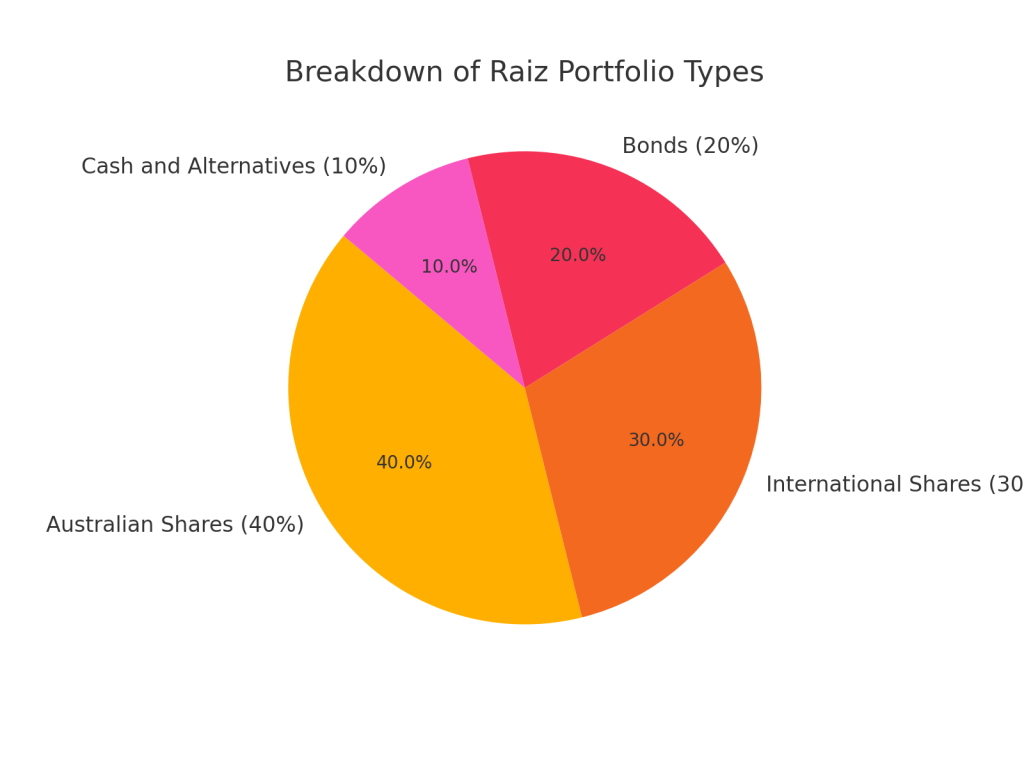

Most micro-investing platforms offer diversified portfolios, spreading investments across various asset classes like stocks, bonds, and ETFs to reduce risk.

4. Micro-Investing in the Australian Context

Raiz

Raiz is one of the most popular micro-investing platforms in Australia. It offers a range of diversified portfolios and integrates seamlessly with your bank account for round-ups. Raiz also includes a superannuation feature, allowing users to invest for retirement.

Spaceship

Spaceship focuses on thematic investing, offering portfolios centred on growth or innovation. It’s ideal for Australians looking to invest in forward-thinking companies with growth potential.

CommSec Pocket

This platform by Commonwealth Bank allows Australians to invest in ETFs with as little as $50, making it a great option for those wanting to explore specific sectors or industries.

| Platform | Minimum Investment | Fees | Key Features | Best For |

|---|---|---|---|---|

| Raiz | $5 | $3.50/month for balances under $15,000 | Round-ups, diversified portfolios, superannuation | Beginners and consistent savers |

| Spaceship | $1 | No fees for balances under $100; 0.10%–0.05% for higher balances | Thematic portfolios, auto-deposits | Those interested in growth-oriented investments |

| CommSec Pocket | $50 | $2/trade | Sector-specific ETFs, backed by Commonwealth Bank | Investors wanting more control |

Key Tip

Compare fees, portfolio options, and features of different platforms to find the best fit for your needs.

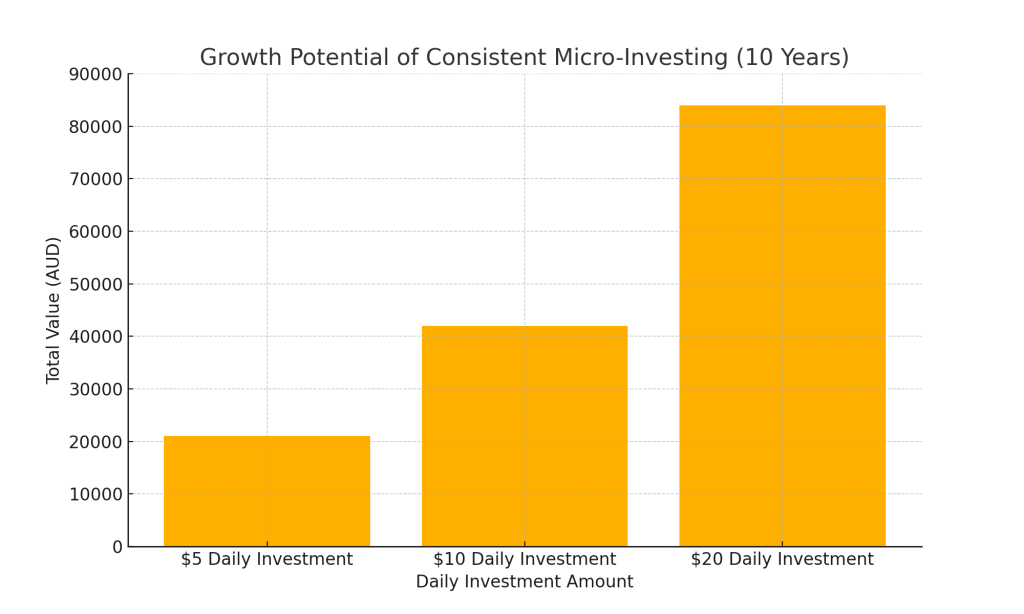

5. Building Wealth Through Consistency

The key to micro-investing success is consistency. Regular contributions, no matter how small, accumulate over time. For example, investing $5 daily amounts to $1,825 annually. With an average return of 5–7% per year, your wealth can grow significantly over decades. Australians can take advantage of tools like Raiz’s recurring investment feature or Spaceship’s auto-deposit to ensure consistency.

Key Tip

Set a realistic budget for your contributions to avoid disrupting your daily financial needs.

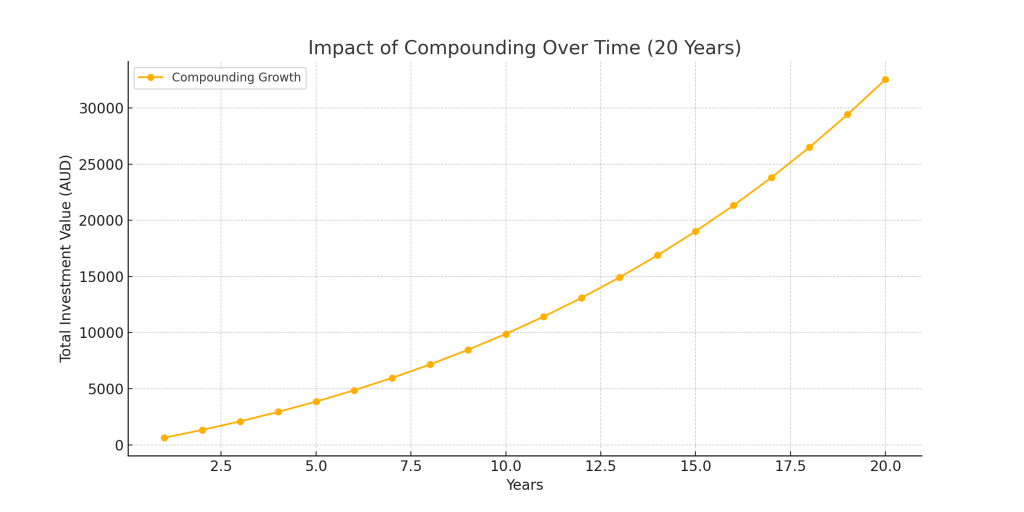

6. The Role of Compounding in Micro-Investing

Compounding plays a crucial role in growing wealth through micro-investing. When earnings from investments are reinvested, they generate additional returns, creating a snowball effect. The longer your money stays invested, the more significant the impact of compounding. For Australians starting early, this can lead to substantial growth over time, even with modest contributions.

Key Tip

Stay invested for the long term to maximise the benefits of compounding.

7. Risk and Rewards of Micro-Investing

Low Risk for Beginners

Micro-investing platforms typically offer diversified portfolios, spreading risk across multiple assets. This makes them suitable for beginners.

Volatility

Like any investment, micro-investing is not immune to market fluctuations. While short-term volatility can be unsettling, long-term growth often outweighs temporary dips.

Fees

Micro-investing platforms charge fees, which can seem significant for smaller balances. Australians should compare fees across platforms to ensure they align with their investment goals.

Key Tip

Understand the risks involved and choose portfolios that match your risk tolerance.

8. Integrating Micro-Investing with Broader Financial Goals

Micro-investing should complement, not replace, broader financial strategies. Use it as a stepping stone to develop disciplined saving and investing habits. Combine micro-investing with a comprehensive financial plan, including emergency savings, debt repayment, and retirement contributions. For Australians, integrating micro-investing with superannuation accounts or ETFs can diversify wealth-building strategies further.

Key Tip

Set specific financial goals, such as saving for a holiday or a home deposit, to keep yourself motivated.

9. How to Get Started

- Research Platforms: Compare features, fees, and portfolios of micro-investing apps like Raiz, Spaceship, and CommSec Pocket.

- Set Goals: Define what you want to achieve with your investments, whether it’s wealth growth, education savings, or retirement planning.

- Start Small: Begin with round-ups or small contributions to get comfortable with the process.

- Monitor Progress: Use app insights and updates to track your investment performance and make adjustments as needed.

Key Tip

Start today—even the smallest contribution sets you on the path to building wealth.

10. The Future of Micro-Investing

Micro-investing is more than a trend; it’s a gateway to financial empowerment for Australians. As technology evolves, platforms are likely to offer even more personalised and accessible options. The integration of micro-investing with other financial tools, like budgeting apps and superannuation, ensures that everyday Australians can take control of their financial futures.

Micro-investing has transformed the way Australians build wealth, making investing accessible, affordable, and achievable. By starting small, staying consistent, and leveraging the power of compounding, anyone can grow their wealth over time. Whether you’re new to investing or looking for a low-risk way to diversify your portfolio, micro-investing offers a practical solution tailored to modern financial needs. Start your journey today and watch your small investments turn into significant financial achievements.