Managing family finances can often feel like a juggling act. From groceries and utility bills to school fees and extracurricular activities, the expenses add up quickly. However, with thoughtful planning and a few clever strategies, Australian families can save money without compromising their quality of life. Budgeting doesn’t have to mean cutting out all the fun—it’s about being smart with your money and focusing on what truly matters. This guide is packed with practical budgeting hacks tailored to Australian families, helping you take control of your finances and achieve your financial goals.

1. Create a Family Budget

A solid family budget is the foundation of effective money management. Start by tracking your household income and expenses using tools like the MoneySmart Budget Planner provided by the Australian Government. Categorise your spending into essentials (rent, utilities, groceries), discretionary spending (entertainment, dining out), and savings. Applying the 50/30/20 rule—50% for needs, 30% for wants, and 20% for savings—can help structure your budget.

Key Tip

Involve the whole family in budgeting discussions to teach financial responsibility and encourage teamwork.

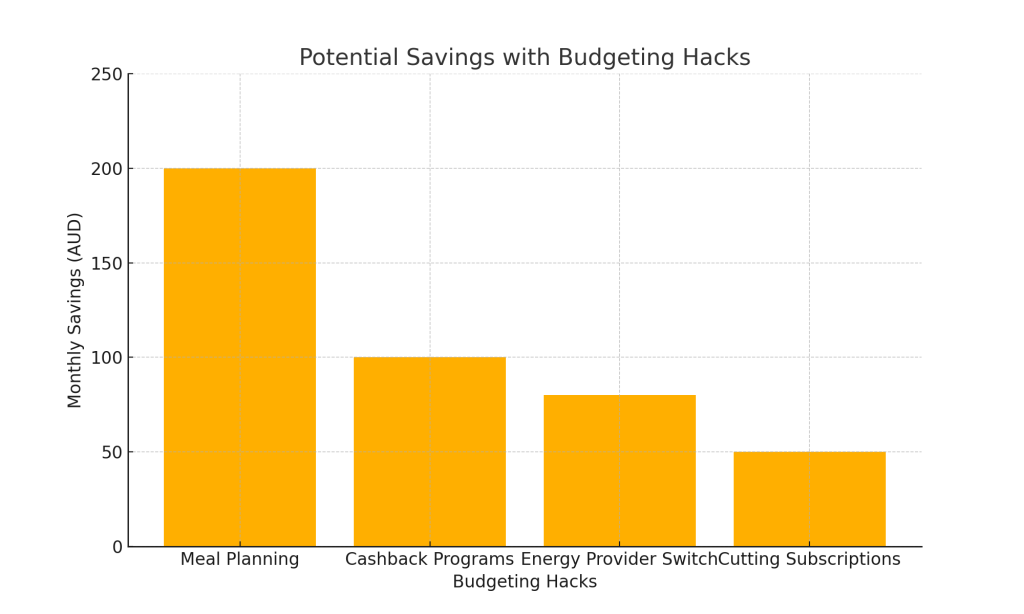

2. Plan Your Meals and Grocery Shopping

Groceries are a significant expense for most families, but planning ahead can save both time and money. Write a weekly meal plan and make a shopping list to avoid impulse buys. Shopping at Aldi or bulk-buying non-perishable items can significantly reduce costs. Use apps like Frugl or HalfPrice to compare prices and find deals at Coles and Woolworths.

Key Tip

Cook in bulk and freeze meals to save time on busy weeknights while reducing food waste.

3. Take Advantage of Cashback and Rewards Programs

Programs like Flybuys and Everyday Rewards offer discounts and points that can be redeemed for groceries, fuel, and more. Cashback apps like ShopBack and Cashrewards also provide money back on online purchases. For Australian families, these programs are a simple way to save on everyday expenses without changing your lifestyle.

| Program Name | Partner Retailers | Benefits | Best For |

|---|

| Flybuys | Coles, Kmart, Target | Earn points for groceries and everyday items | Families shopping regularly at Coles and partners |

| Everyday Rewards | Woolworths, Big W, BWS | Redeem points for discounts on groceries | Woolworths shoppers looking for regular savings |

| ShopBack | Amazon, The Iconic, Booking.com | Cashback on online purchases | Online shoppers |

| Cashrewards | Myer, David Jones, eBay | Cashback on major retail purchases | Families making large or frequent online purchases |

Key Tip

Use rewards points strategically during sales or promotions to maximise savings.

4. Cut Back on Subscriptions

It’s easy for families to accumulate subscriptions for streaming services, fitness apps, and online memberships. Review your monthly subscriptions and cancel any that are underused. For services like Netflix or Spotify, consider sharing accounts with trusted family members or friends to split the cost.

Key Tip

Check your bank statements regularly to identify and cancel unused subscriptions.

5. Save on Energy Bills

Energy costs can take a big chunk out of a family’s budget, but there are ways to cut back. Simple actions like switching to LED bulbs, using energy-efficient appliances, and unplugging devices when not in use can reduce consumption. Solar panels are another long-term investment that can significantly lower electricity costs. Websites like Energy Made Easy help Australian families compare energy providers to find the best deal.

Key Tip

Use a smart thermostat to control heating and cooling costs more efficiently.

6. Opt for Free or Low-Cost Entertainment

Keeping the family entertained doesn’t have to break the bank. Take advantage of Australia’s abundant outdoor spaces, like parks, beaches, and hiking trails, which are free to access. Many cities also offer free community events, museums, and libraries. For at-home fun, host a family game or movie night.

Key Tip

Check local council websites for free events and activities in your area.

7. Save on School Costs

Back-to-school shopping can be expensive, but there are ways to cut costs. Buy uniforms and supplies during sales or second-hand from online marketplaces like Facebook Marketplace or Gumtree. For school lunches, preparing meals at home instead of buying pre-packaged items saves money and promotes healthier eating.

Key Tip

Label school supplies to reduce the chances of needing replacements throughout the year.

8. Embrace DIY Solutions

From home repairs to personal grooming, there are many tasks families can do themselves to save money. Learn simple DIY skills through YouTube tutorials or community workshops. Similarly, making your own cleaning products using household ingredients like vinegar and baking soda can save money and reduce chemical use.

Key Tip

Start small with DIY projects and gradually tackle more complex tasks as your confidence grows.

9. Shop Second-Hand

Thrifting isn’t just trendy; it’s a great way to save money on clothing, furniture, and toys. Op shops like Salvos and Vinnies, as well as online platforms like eBay, Gumtree, and Facebook Marketplace, are treasure troves of affordable items. For children’s clothing and toys, consider organising swaps with other parents.

Key Tip

Set alerts on online platforms for items you’re looking for to grab deals quickly.

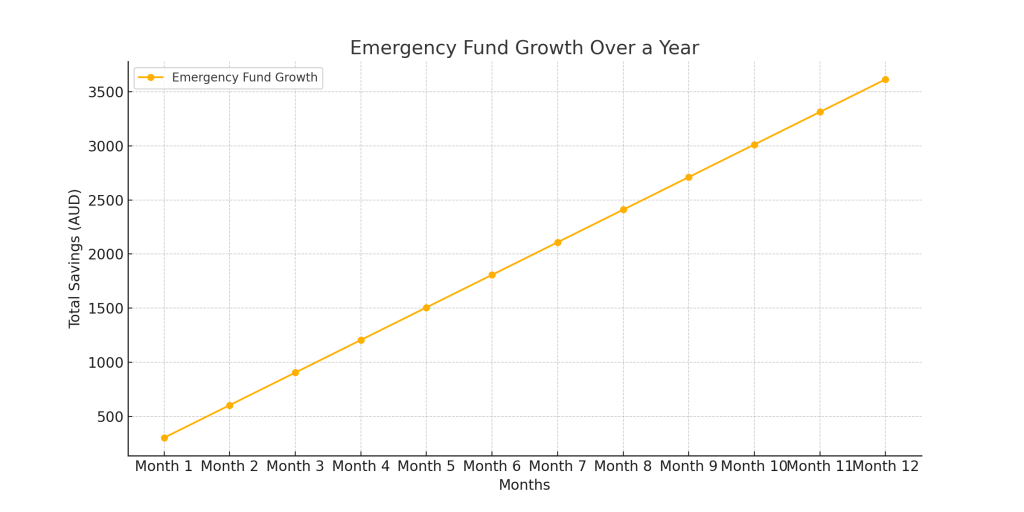

10. Build an Emergency Fund

Life is unpredictable, and having an emergency fund provides peace of mind. Aim to save three to six months’ worth of essential expenses to cover unexpected costs like medical bills or car repairs. Open a high-interest savings account with providers like UBank or ING to grow your fund faster.

Key Tip

Automate savings transfers each month to ensure consistency.

11. Use Public Transport or Carpool

Transport costs can add up quickly for families, but there are ways to reduce them. Use public transport cards like Opal (NSW) or Myki (VIC) to take advantage of discounts and capped fares. If driving is necessary, carpooling with neighbours or friends can help share fuel and parking costs.

Key Tip

Plan trips during off-peak hours to save on fares and avoid traffic congestion.

12. Teach Kids Financial Literacy

Instilling good money habits in children sets them up for a financially secure future. Teach them the value of saving by encouraging them to put aside a portion of their pocket money. Use child-friendly apps like Spriggy to help them track their spending and savings.

Key Tip

Reward children for reaching savings goals to keep them motivated.

Budgeting as a family doesn’t have to be restrictive; it’s about making intentional choices and finding opportunities to save. By implementing these budgeting hacks, Australian families can manage their finances more effectively, reduce financial stress, and work toward their financial goals. Remember, every small saving adds up, creating a more secure and enjoyable future for your family.