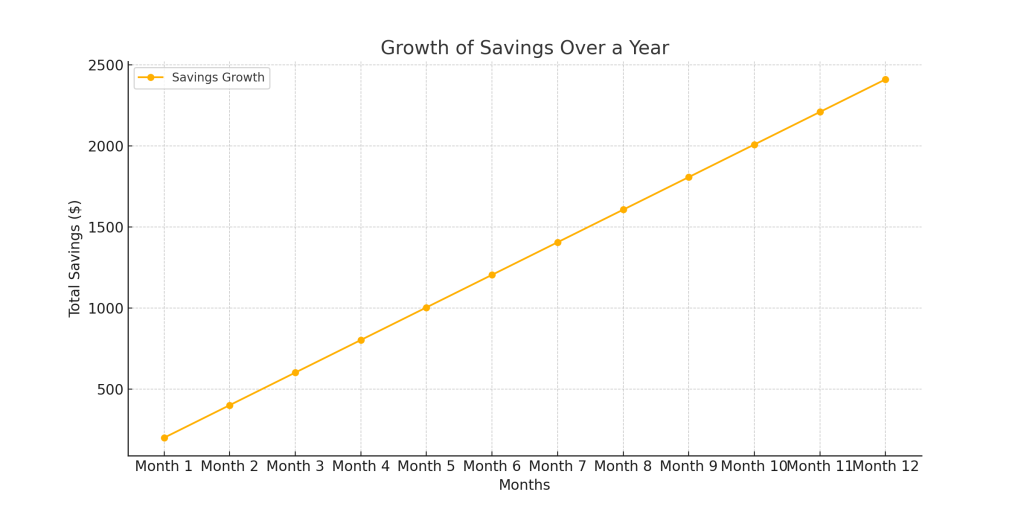

In a world where every dollar counts, the importance of saving can’t be overstated. While it might seem insignificant to save a few dollars here and there, those small savings can accumulate into significant amounts over time. Australians, grappling with rising living costs and economic uncertainty, can benefit immensely from adopting a mindset of frugality. By making incremental adjustments to daily spending and embracing practical strategies, you can grow your savings and achieve financial goals without feeling deprived. Here’s a comprehensive guide on how to turn small savings into meaningful financial growth.

1. Embrace the Power of Compounding

Compounding is the secret ingredient that makes small savings grow exponentially. When you save money in a high-interest account or invest it, your earnings generate additional income over time. For Australians, platforms like Raiz and Spaceship make investing accessible, allowing you to start with as little as $5. Regular contributions, no matter how small, can accumulate significant amounts thanks to compounding.

Key Tip

Set up automatic transfers into a savings account or investment portfolio to ensure consistent growth.

2. Round Up Your Purchases

Many Australian banks and apps, like Up Bank or ING, offer round-up savings features. This tool rounds up your purchases to the nearest dollar and transfers the difference into a savings account. For example, buying a coffee for $4.50 results in $0.50 being saved. While these amounts seem trivial, they add up over time and provide a hassle-free way to grow your savings.

Key Tip

Activate round-up features through your bank’s mobile app to save effortlessly with every purchase.

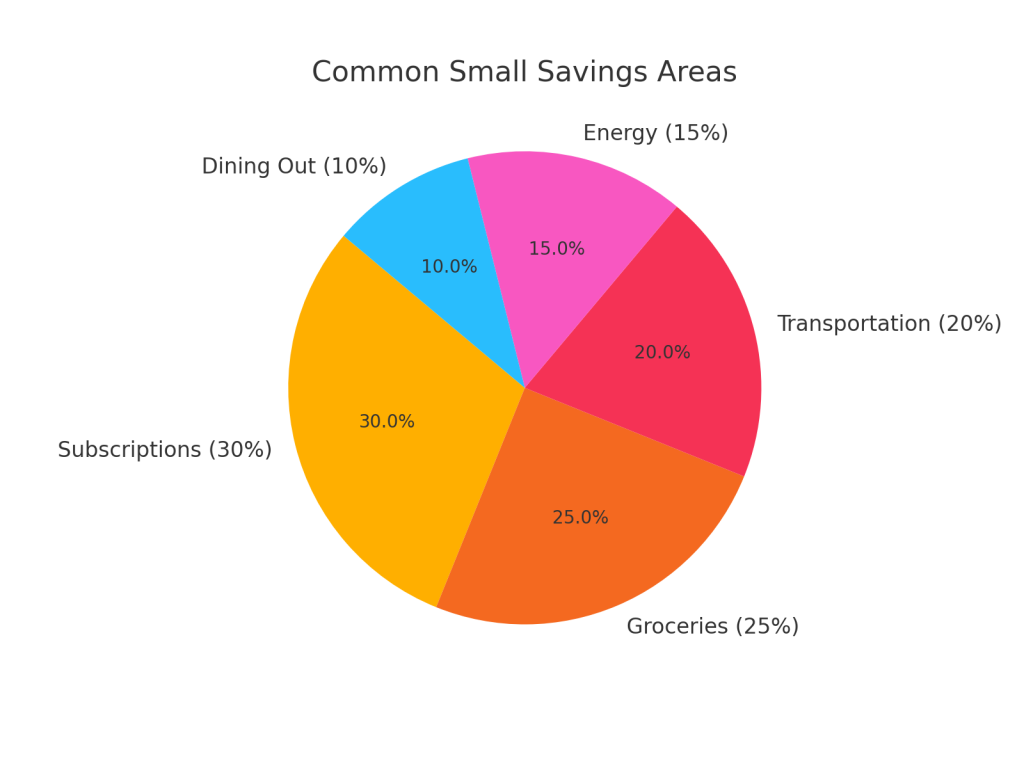

3. Cut Back on Subscriptions

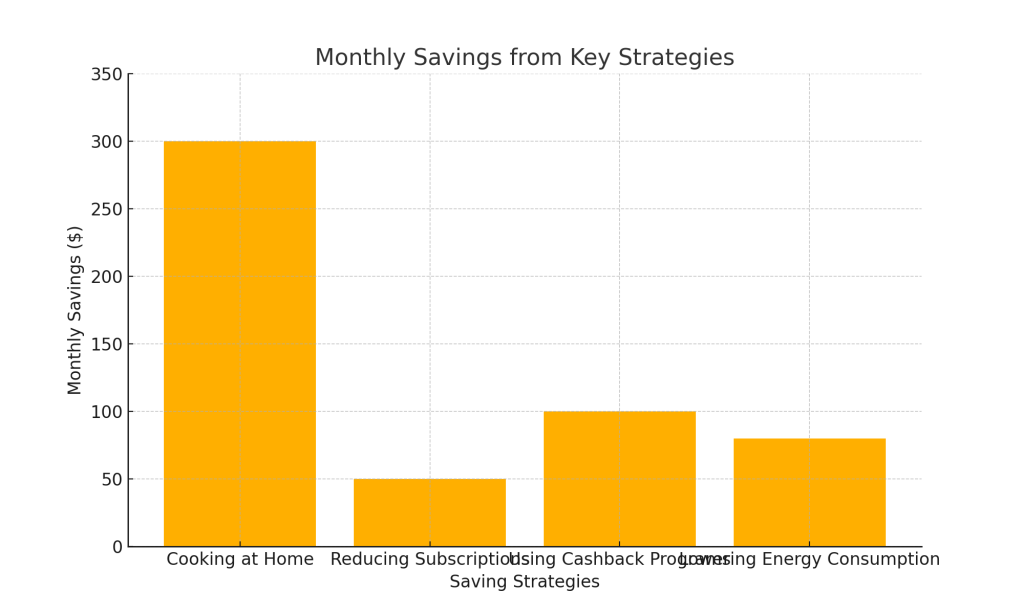

Reviewing your subscriptions is a simple yet effective way to save money. Australians often spend on multiple streaming services, gym memberships, and app subscriptions. Cancel any services you rarely use, and consider sharing subscriptions with family or friends to reduce costs. For example, splitting Netflix or Spotify accounts can halve your monthly expenses.

Key Tip

Check your bank statements to identify unused subscriptions and take action to cancel them.

4. Buy in Bulk

Purchasing non-perishable items like toiletries, cleaning supplies, and pantry staples in bulk can save you money in the long run. Retailers like Costco or online platforms such as Catch.com.au offer discounts for bulk purchases. For fresh produce, farmers’ markets often provide affordable, high-quality options.

Key Tip

Compare prices per unit to ensure bulk purchases genuinely offer better value.

5. Reduce Energy Consumption

Cutting back on energy use is not only good for your wallet but also for the environment. Simple actions like switching to energy-efficient LED bulbs, unplugging devices when not in use, and using ceiling fans instead of air conditioning can significantly lower your electricity bills. Solar power installations, supported by Australian government rebates, are a long-term investment worth considering.

Key Tip

Use tools like Energy Made Easy to compare providers and ensure you’re on the best energy plan.

6. Cook at Home

Dining out frequently or ordering takeaway adds up quickly. Cooking at home is a cost-effective alternative that also allows you to control ingredients and portion sizes. Plan your meals for the week, and make a shopping list to avoid impulse purchases. For coffee lovers, brewing your coffee at home can save hundreds annually.

Key Tip

Batch cook meals and freeze portions for quick, convenient, and affordable dinners.

7. Leverage Cashback Programs

Cashback apps like ShopBack and Cashrewards let you earn money back on everyday purchases. From groceries and clothing to travel bookings, these platforms partner with Australian retailers to provide a percentage of your spend as cashback. Over time, the savings from cashback can make a significant impact.

Key Tip

Check for cashback offers before making online purchases to maximise savings.

8. Save on Transportation

Transportation is a major expense for many Australians, but there are ways to cut costs. Use public transport cards like Opal (NSW) or Myki (VIC) to benefit from capped daily fares. For drivers, carpooling, regular vehicle maintenance, and using fuel comparison apps like FuelCheck can reduce costs. Cycling or walking for shorter trips is not only economical but also improves fitness.

Key Tip

Plan travel during off-peak hours to save on public transport fares and avoid toll charges.

9. Take Advantage of Rewards Programs

Loyalty programs such as Flybuys and Everyday Rewards can provide discounts and perks when shopping at major Australian retailers like Coles and Woolworths. Accumulated points can be redeemed for gift cards, travel vouchers, or discounts on future purchases. The key is to stick to your regular shopping habits without overspending to earn rewards.

Key Tip

Link your rewards accounts to payment apps for seamless tracking and redemption of points.

10. Track Your Progress

Monitoring your savings journey keeps you motivated and helps you stay on track. Use apps like MoneyBrilliant or Pocketbook to categorise your expenses and savings. Seeing the growth of your savings, no matter how incremental, reinforces positive habits and encourages further effort.

Key Tip

Set monthly goals for your savings and review them regularly to celebrate milestones.

Making small savings add up over time requires consistency, discipline, and a proactive approach. By embracing strategies like compounding, cutting back on unnecessary expenses, and leveraging tools like cashback apps and rewards programs, Australians can turn modest savings into significant financial gains. Remember, every dollar saved today contributes to a more secure financial future. Start implementing these tips today, and watch how your small efforts lead to big results over time.