Financial resilience is the ability to withstand and recover from unexpected financial challenges. Whether it’s a sudden job loss, medical emergency, or economic downturn, being financially prepared can make all the difference. For Australians, with the rising cost of living and ongoing economic uncertainties, building financial resilience has never been more critical. The good news is that with the right strategies, you can strengthen your financial foundation and secure a stable future. This guide will outline proven methods tailored to the Australian context to help you safeguard your finances and achieve long-term stability.

1. Create a Comprehensive Budget

A solid budget is the cornerstone of financial resilience. Start by tracking your income and expenses to understand your financial habits. Use tools like the Australian Government’s MoneySmart Budget Planner to categorise your spending into essentials, discretionary items, and savings. Apply the 50/30/20 rule: allocate 50% of your income to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings or debt repayment. Regularly review and adjust your budget as your circumstances change.

Key Tip

Utilise budgeting apps like Pocketbook or Frollo to automate tracking and identify areas for improvement.

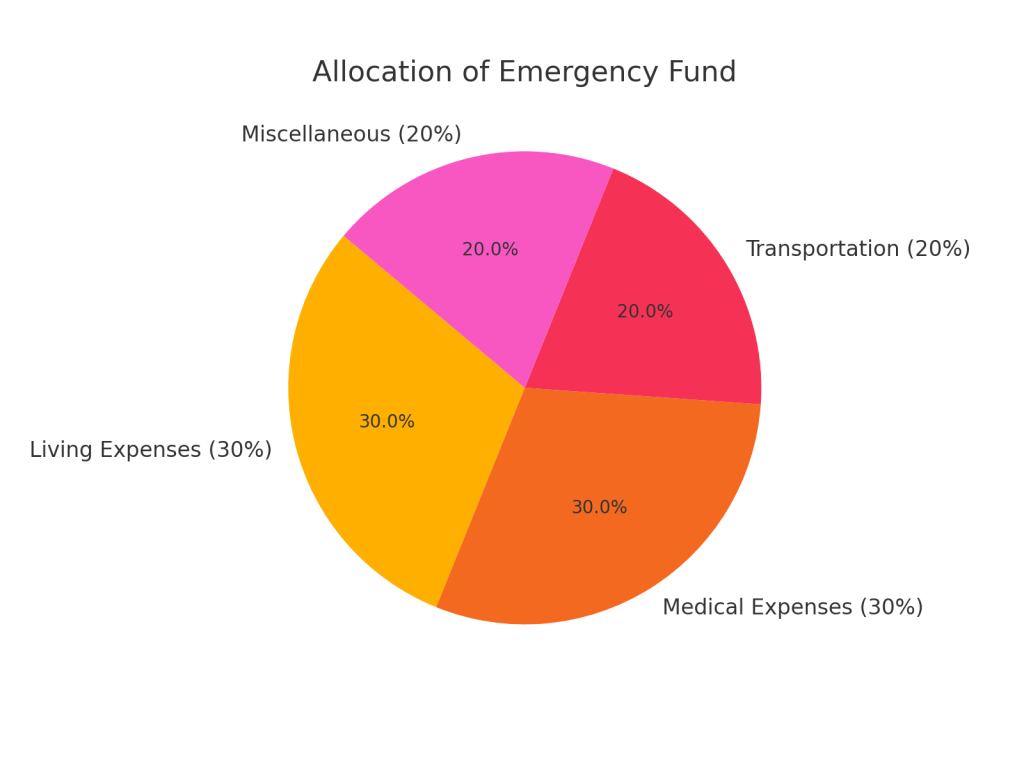

2. Build an Emergency Fund

An emergency fund is essential for financial resilience. Aim to save three to six months’ worth of living expenses to cover unexpected costs like medical bills, car repairs, or temporary unemployment. Start small by setting aside a portion of your income each month. Open a high-interest savings account with Australian banks like ING or UBank to grow your fund faster. Automating deposits can help you stay consistent.

Key Tip

Treat your emergency fund as untouchable unless faced with a true financial emergency.

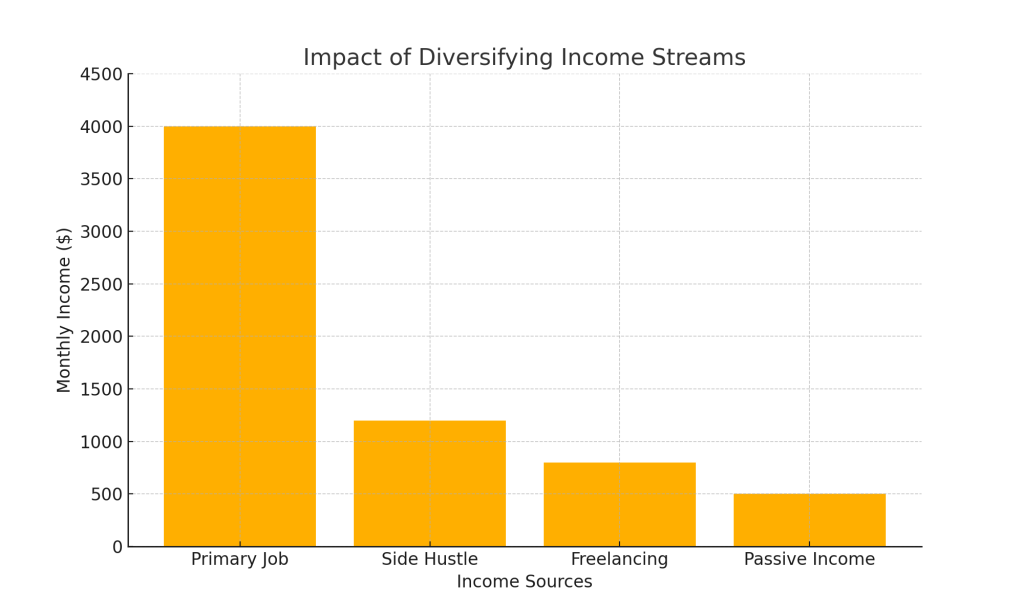

3. Diversify Your Income Streams

Relying on a single source of income can make you vulnerable during economic downturns. Consider exploring side hustles or freelance opportunities to supplement your earnings. Platforms like Airtasker or Freelancer offer flexible work options for Australians. Investing in upskilling through online courses can also open doors to higher-paying roles or new industries.

Key Tip

Focus on income sources aligned with your skills and interests to ensure sustainability.

4. Manage and Reduce Debt

High-interest debt can be a significant barrier to financial resilience. Prioritise paying off debts with the highest interest rates, such as credit cards or personal loans. Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and reduce costs. If you’re struggling, consider reaching out to financial counselling services like the National Debt Helpline for free advice tailored to Australians.

Key Tip

Use the debt snowball method by paying off smaller debts first to build momentum and motivation.

5. Invest in Insurance Protection

Insurance acts as a safety net for unforeseen events. Ensure you have adequate coverage for health, home, car, and life insurance. Compare policies from providers like iSelect or Finder to find the best deals. For Australians, government initiatives like Medicare and the Private Health Insurance Rebate can reduce healthcare costs. Review your policies annually to ensure they meet your needs and remain cost-effective.

Key Tip

Consider income protection insurance to safeguard against loss of income due to illness or injury.

6. Strengthen Your Financial Knowledge

Financial literacy is key to making informed decisions. Take advantage of resources like MoneySmart, which offers free guides and tools for Australians. Attend workshops, webinars, or courses on personal finance, investing, and money management. The more you understand about managing money, the better equipped you’ll be to navigate financial challenges.

Key Tip

Follow reputable Australian finance blogs or podcasts to stay updated on economic trends and strategies.

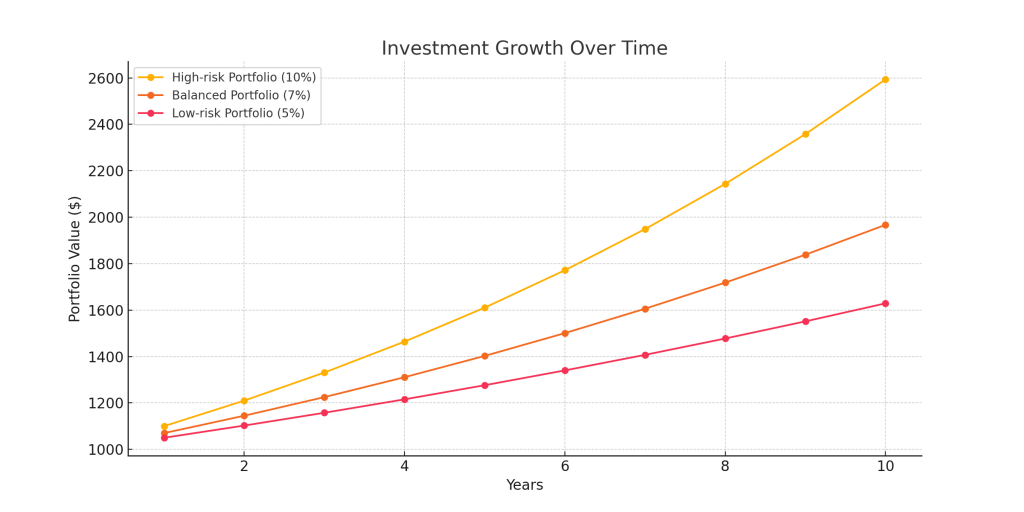

7. Diversify Investments

Building wealth through investment is a critical component of financial resilience. Avoid putting all your money into one asset class, such as shares or property. Instead, diversify across multiple assets, including bonds, stocks, ETFs, and real estate. Platforms like CommSec or Raiz make investing accessible to Australians with varying levels of experience. Always consider your risk tolerance and consult a financial advisor if needed.

Key Tip

Regularly review your investment portfolio to ensure it aligns with your financial goals and market conditions.

8. Live Below Your Means

Spending less than you earn is a fundamental principle of financial resilience. Avoid lifestyle inflation by distinguishing between needs and wants. Focus on saving and investing any additional income rather than increasing discretionary spending. For Australians, this might mean cooking at home more often, avoiding unnecessary upgrades, and shopping during sales like EOFY (End of Financial Year) for discounts.

Key Tip

Track expenses regularly to ensure they align with your financial goals.

9. Plan for Retirement Early

Preparing for retirement is a long-term strategy that contributes to financial resilience. Australians should regularly review their superannuation accounts to ensure adequate contributions and growth. Compare super funds on platforms like Canstar to find those with low fees and strong performance. Consider making additional contributions to boost your retirement savings, especially if you’re nearing retirement age.

Key Tip

Take advantage of government co-contributions to maximise your superannuation growth.

10. Build a Support Network

Financial resilience isn’t just about money; it’s also about having a support system. Surround yourself with individuals who encourage good financial habits and provide guidance during tough times. Join local financial literacy groups or online communities where Australians share tips and experiences. A strong network can offer emotional support and practical advice when navigating financial challenges.

Key Tip

Engage with mentors or advisors who can provide personalised financial strategies.

Building financial resilience is a journey that requires intentional effort and adaptability. By budgeting effectively, saving for emergencies, diversifying income and investments, and making informed financial decisions, you can protect yourself against uncertainties and secure your future. These strategies, tailored for Australians, provide a roadmap to financial stability and peace of mind. Start implementing these steps today to strengthen your financial foundation and achieve lasting resilience.