In today’s fast-paced world, managing finances can feel overwhelming. Thankfully, technology has transformed personal finance management, offering tools that make budgeting, saving, and investing easier than ever. For Australians, where the cost of living is rising, these apps provide a much-needed solution to stay on top of expenses and achieve financial goals. Whether you’re looking to track spending, save for a home deposit, or simply gain control over your finances, the right app can make all the difference. Here’s a guide to the best apps for managing your money in Australia, tailored to meet a variety of financial needs.

1. Pocketbook: Simplify Your Budgeting

Pocketbook is one of Australia’s most popular personal finance apps, and for a good reason. It seamlessly links to your bank accounts, categorising transactions into predefined and custom spending categories. The app provides a clear snapshot of your spending habits, making it easier to identify where you might be overspending. Its “Safe Spending” feature is particularly useful, as it shows how much disposable income you have after accounting for upcoming bills. Pocketbook is ideal for Australians looking to maintain a budget without the hassle of manual tracking.

Key Features

- Automatic syncing with major Australian banks.

- Real-time budget tracking and expense categorisation.

- Bill reminders to avoid late fees.

Best For

Individuals who want a straightforward, no-fuss budgeting app tailored for Australian users.

2. Raiz: Start Investing with Spare Change

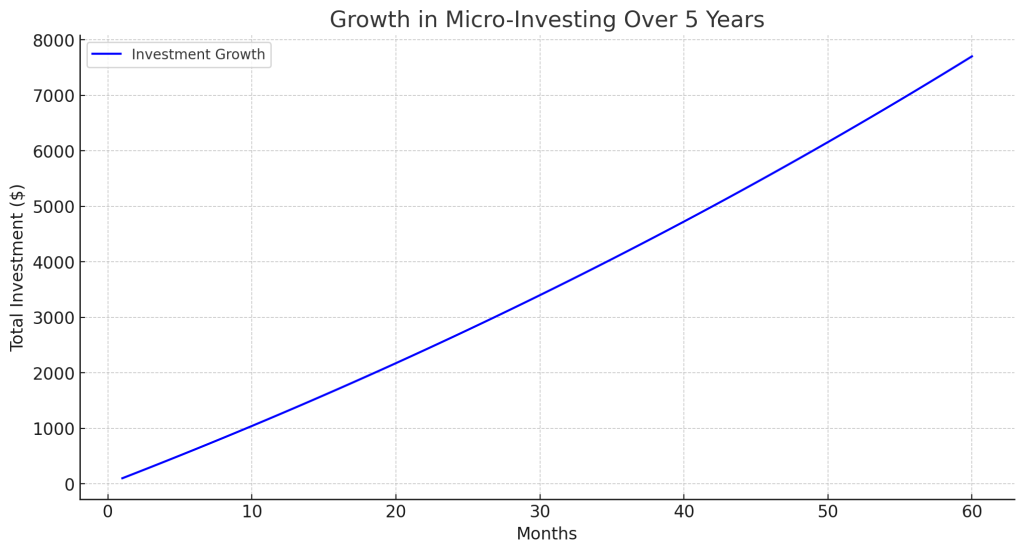

Raiz, formerly known as Acorns, is perfect for Australians who want to dip their toes into investing without a large upfront commitment. The app rounds up your everyday purchases to the nearest dollar and invests the spare change into diversified portfolios. With Raiz, you can also set up recurring investments, contributing as little as $5 at a time. It’s an excellent tool for those new to investing or anyone looking to build wealth passively.

Key Features

- Automated micro-investing with spare change.

- Customisable investment portfolios, including socially responsible options.

- Integration with your Australian superannuation for long-term savings.

Best For

Australians who want an easy way to start investing without needing extensive financial knowledge.

3. Frollo: Track, Budget, and Save

Frollo is a comprehensive financial management app that helps Australians get a complete picture of their finances. By securely linking all your accounts, including credit cards, savings, and superannuation, Frollo provides insights into your spending habits and financial health. The app’s budgeting feature lets you set spending limits for different categories, helping you save effectively. Its “Insights” feature flags unusual transactions, ensuring you stay alert to potential fraud or overspending.

Key Features

- Secure account aggregation across Australian banks and institutions.

- Real-time financial insights and transaction categorisation.

- Goal-setting tools to track savings progress.

Best For

Users seeking an all-in-one app to manage their finances and save effectively.

4. MoneyBrilliant: Your Personal Financial Coach

MoneyBrilliant is a robust app designed for Australians who want to take their financial planning to the next level. It goes beyond basic budgeting by offering features like tax-deductible expense tracking and superannuation comparison. The app also highlights potential savings by analysing your bills and subscriptions, suggesting better deals. MoneyBrilliant’s ability to integrate with Australian-specific tax rules makes it a standout option for freelancers and small business owners.

Key Features

- Personalised financial insights and tax deduction tracking.

- Bill optimisation to reduce recurring expenses.

- Superannuation comparison and consolidation recommendations.

Best For

Freelancers, small business owners, or anyone looking for advanced financial planning tools.

5. Splitwise: Simplify Shared Expenses

Splitting bills with friends, family, or housemates can often be tricky. Splitwise solves this problem by tracking shared expenses and calculating who owes whom. The app is particularly useful for Australians living in shared accommodations or planning group holidays. With Splitwise, you can add expenses, split them equally or unequally, and settle payments directly through integrations with payment apps like PayPal.

Key Features

- Easy expense tracking and bill splitting.

- Currency conversion for international travel.

- Payment reminders and debt tracking.

Best For

Australians managing shared expenses or traveling with groups.

6. Goodbudget: Envelope Budgeting, Digitised

Goodbudget brings the classic envelope budgeting system into the digital age. Instead of physically allocating cash into envelopes, you assign portions of your income to digital envelopes for categories like groceries, rent, and entertainment. The app encourages disciplined spending by preventing you from exceeding your budget in each category. While it doesn’t sync with Australian bank accounts, its simplicity makes it appealing for users who prefer manual input.

Key Features

- Envelope budgeting for clear spending limits.

- Cross-device syncing for household budgeting.

- Expense tracking without bank integration.

Best For

Australians looking for a simple and effective budgeting tool, especially for shared financial goals.

7. WeMoney: Build Financial Wellness

WeMoney is a fast-growing app designed for Australians focused on improving their financial wellness. It connects your accounts to offer a real-time view of your finances, track your credit score, and suggest tailored ways to save money. The app also features a supportive community where users can share tips and experiences, creating a collaborative approach to financial health.

Key Features

- Free credit score tracking.

- Financial health insights and personalised recommendations.

- Community support for financial advice.

Best For

Australians interested in holistic financial wellness, including credit score monitoring.

8. Finder: Compare and Save

Finder isn’t just for comparing deals; it’s also a powerful tool for managing your finances. The app allows you to track spending, monitor your credit score, and find better deals on everything from loans to insurance. Its focus on comparison shopping makes it particularly valuable for Australians looking to save money across multiple financial products.

Key Features

- Spend tracking and credit score monitoring.

- Comprehensive comparison tools for Australian products.

- Alerts for savings opportunities.

Best For

Australians looking to save money through smarter financial product choices.

How to Choose the Right App for You

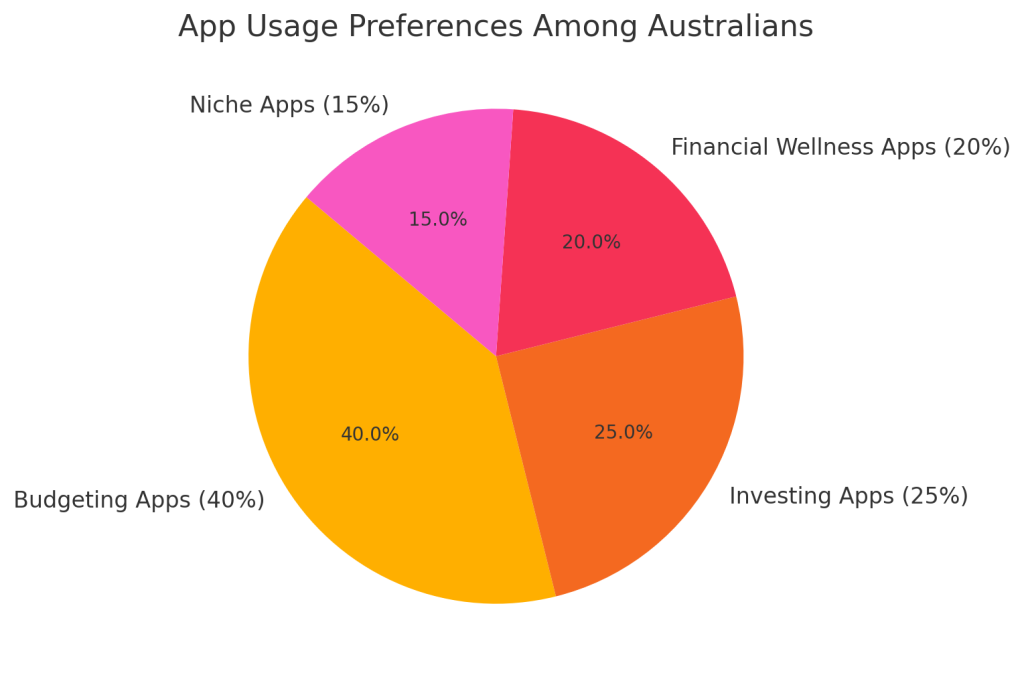

The best app for managing your finances depends on your individual needs and goals. If you’re focused on budgeting, Pocketbook or Frollo might be ideal. For those starting their investment journey, Raiz provides an excellent entry point. Meanwhile, MoneyBrilliant and Finder are great options for comprehensive financial management. Whatever your choice, the key is consistency—use these tools regularly to gain insights, make adjustments, and stay on track with your financial goals.

| App Name | Primary Purpose | Best Features | Ideal For |

|---|---|---|---|

| Pocketbook | Budgeting and expense tracking | Automatic bank syncing, Safe Spending feature | Everyday budgeting and tracking |

| Raiz | Micro-investing | Spare change investing, recurring contributions, ESG portfolios | Beginners in investing |

| Frollo | Comprehensive financial management | Account aggregation, insights, goal tracking | Holistic financial health |

| MoneyBrilliant | Advanced financial planning | Tax tracking, bill optimisation, super comparison | Freelancers, small business owners |

| Splitwise | Managing shared expenses | Bill splitting, debt tracking, PayPal integration | Group travel, shared accommodation |

| Goodbudget | Envelope budgeting | Digital envelope system, cross-device syncing | Manual budgeters and household planners |

| WeMoney | Financial wellness and community | Credit score monitoring, financial insights, community support | Improving financial literacy and wellness |

| Finder | Spend tracking and deal comparison | Product comparisons, credit score monitoring, savings alerts | Cost-conscious individuals |

By leveraging these top apps tailored to the Australian market, you can simplify financial management, save time, and work toward a more secure financial future.