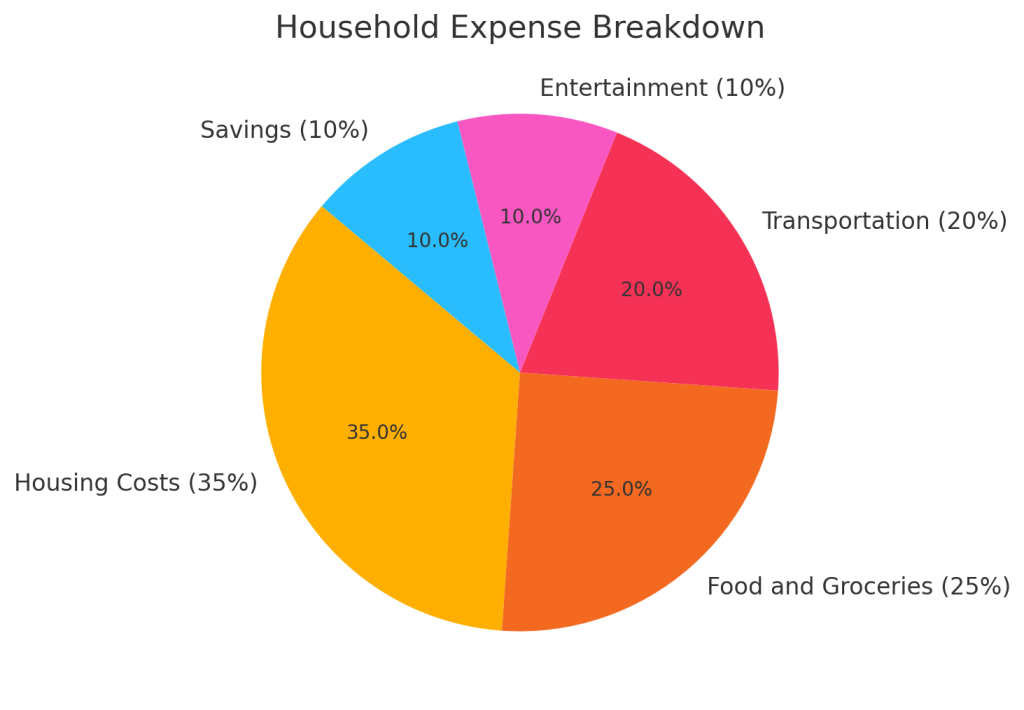

In today’s world, saving money has become more important than ever. Australians face rising living costs, from groceries and energy bills to transportation and entertainment. However, with thoughtful strategies, you can reduce your everyday expenses without sacrificing your quality of life. Whether you’re looking to pay off debt, save for a big purchase, or simply build a safety net, small changes can lead to significant savings. Here are practical, easy-to-implement tips tailored to the Australian market to help you cut costs and achieve financial stability.

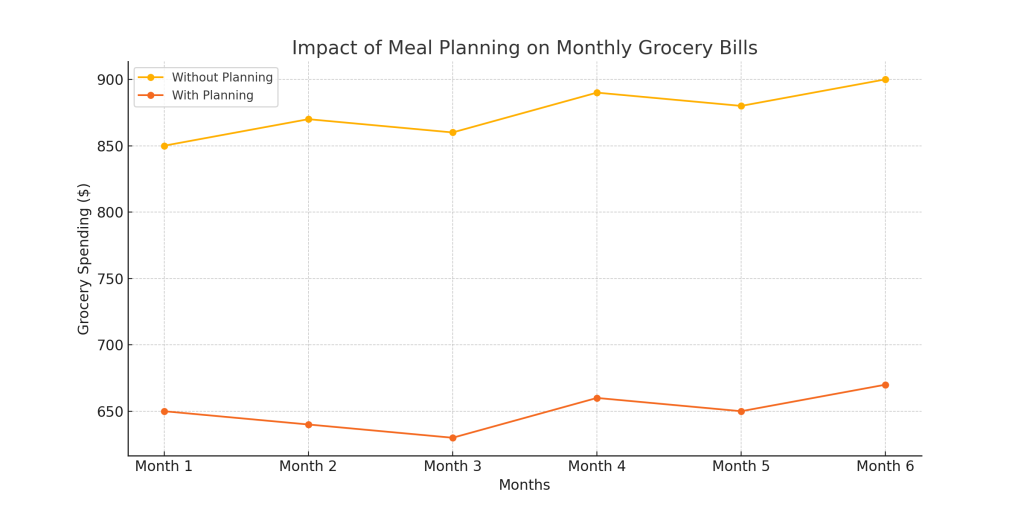

1. Plan Your Meals and Save on Groceries

Groceries are a significant expense for many Australian households, but there are plenty of ways to save. Start by meal planning for the week ahead and making a shopping list to avoid impulse purchases. Look for specials and discounts at major supermarkets like Coles, Woolworths, and Aldi. Buying generic brands instead of name brands can also significantly reduce costs without compromising quality. For fresh produce, visit local farmers’ markets where prices are often lower, and the goods are fresher.

Key Tip

Use grocery comparison apps like Frugl or HalfPrice to find the best deals at stores near you.

2. Reduce Energy Bills

Energy costs are on the rise across Australia, but you can take steps to lower your electricity and gas bills. Start by switching to energy-efficient LED bulbs, which use less power and last longer than traditional bulbs. Turn off appliances at the wall when not in use, as standby power can add up over time. If you’re a homeowner, consider investing in solar panels, which can reduce your energy costs significantly over the long term and even earn you rebates.

Key Tip

Compare energy providers regularly using tools like Energy Made Easy to ensure you’re on the best plan.

3. Use Public Transport or Carpool

Transportation costs, including fuel, car maintenance, and tolls, can quickly add up. For Australians living in cities like Sydney or Melbourne, public transport is a cost-effective alternative to driving. Use transport cards like Opal (NSW) or Myki (Victoria) to benefit from daily caps and off-peak discounts. For those who drive, carpooling with colleagues or friends can help share the costs of fuel and parking.

Key Tip

Plan trips during off-peak hours to save on public transport fares.

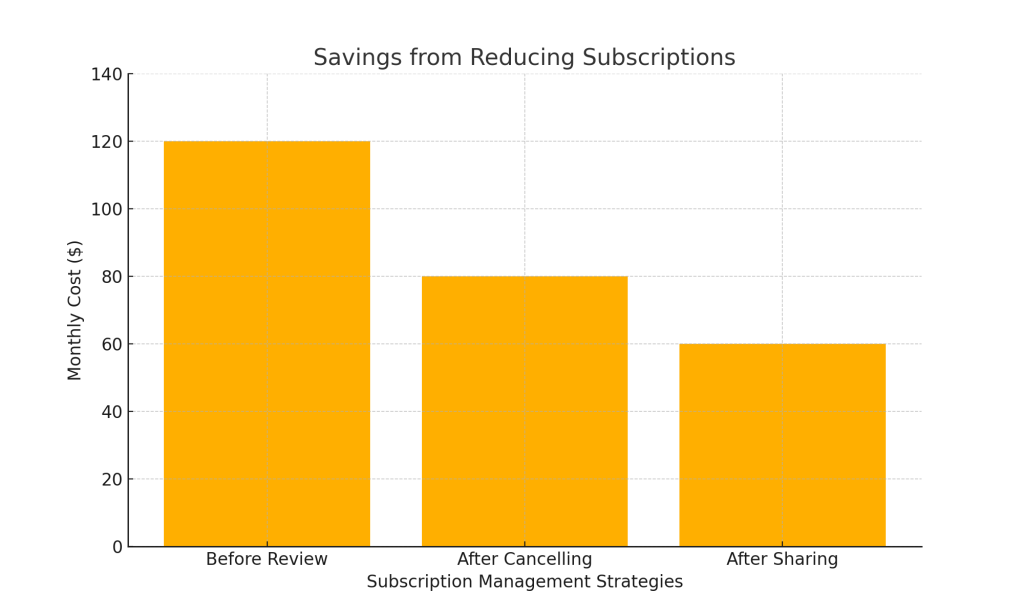

4. Cut Back on Subscriptions

Many Australians find themselves paying for subscriptions they rarely use, whether it’s streaming services, gym memberships, or magazine subscriptions. Take stock of your recurring expenses and cancel any services you no longer need. For streaming, consider sharing accounts with family or friends to split the cost. If you’re a gym-goer, explore pay-per-visit options or outdoor workouts as cost-effective alternatives.

Key Tip

Review your bank statements to identify and cancel unused subscriptions.

5. Shop Smart for Household Items

Household goods can be expensive, but savvy shopping can make a big difference. Purchase items like cleaning supplies, toiletries, and pantry staples in bulk to save money in the long run. Retailers like Costco or online platforms like Catch.com.au often offer discounts for buying in bulk. Thrift shops like Vinnies and Salvos are excellent places to find affordable furniture, clothing, and home goods.

Key Tip

Wait for seasonal sales, such as the EOFY (End of Financial Year) sales, to buy high-ticket items at a discount.

6. Dine Out Less and Cook More

Eating out frequently can take a toll on your wallet. Cooking at home is a more cost-effective alternative and often healthier too. Make dining out a special occasion rather than a habit. When you do go out, look for discounts on apps like TheFork or Groupon. For coffee lovers, brewing your own at home can save hundreds annually compared to daily café visits.

Key Tip

Batch cook meals and freeze portions to save time and reduce the temptation to order takeaway.

7. Use Cashback and Rewards Programs

Maximise your spending with cashback apps like ShopBack and Cashrewards, which let you earn money back on purchases at participating retailers. Loyalty programs such as Everyday Rewards (Woolworths) or Flybuys (Coles) allow you to accumulate points that can be redeemed for discounts or rewards. Be mindful not to overspend simply to earn rewards.

Key Tip

Activate cashback offers before making online purchases to ensure you don’t miss out.

8. Lower Your Insurance Premiums

Insurance is a necessary expense, but you might be paying more than you need to. Compare car, health, and home insurance providers to ensure you’re getting the best rate. Many insurers offer discounts for bundling policies or increasing your excess. If you rarely make claims, consider switching to a policy with a higher excess for lower premiums.

Key Tip

Use comparison websites like iSelect or Finder to shop for competitive insurance quotes.

9. Embrace DIY Projects

Learning to do simple repairs and maintenance tasks yourself can save you a lot of money. From fixing leaky taps to repainting walls, there’s plenty you can do with a bit of effort and the right tools. YouTube is an excellent resource for tutorials. Similarly, try DIY gifts or decorations to save money on holidays and celebrations.

Key Tip

Start small with DIY projects and build your skills over time.

10. Save on Entertainment

Entertainment doesn’t have to break the bank. Take advantage of free or low-cost activities like visiting local parks, hiking trails, and community events. Many Australian cities offer free museum entries and outdoor movie screenings. If you love reading, borrow books from your local library instead of buying them.

Key Tip

Set a monthly entertainment budget to ensure you don’t overspend on leisure activities.

Saving money on everyday expenses is about making mindful choices and taking advantage of opportunities to cut costs. From reducing energy bills and cutting back on subscriptions to shopping smart and embracing DIY solutions, small changes can add up to significant savings. By applying these practical tips, Australians can stretch their dollars further and achieve their financial goals without compromising their lifestyle.