Creating a budget is one of the most empowering steps you can take toward achieving financial freedom. It’s not just about cutting costs; it’s about gaining control over your money, understanding where it goes, and aligning your spending with your goals. For Australians facing rising living costs, a tailored budgeting strategy can make all the difference. Whether you’re saving for a house deposit, planning a dream vacation, or managing everyday expenses, this guide will walk you through the steps to create a budget that works for you and helps you build a secure financial future.

1. Understand Your Financial Snapshot

To build a budget, start with a clear understanding of your financial situation. Begin by calculating your total monthly income, including all sources such as your salary, freelance income, or government benefits like Centrelink. Next, track your expenses over a typical month to identify spending patterns. Apps like Pocketbook or MoneyBrilliant are excellent tools for Australians to categorise expenses into needs, wants, and savings. Finally, list your debts, including credit cards, personal loans, or car repayments, and take note of any existing savings.

Key Tip

Knowing your financial starting point provides clarity and lays the foundation for effective budgeting.

2. Set Clear Financial Goals

Your budget should be aligned with your short- and long-term financial objectives. Short-term goals might include paying off a high-interest credit card or building an emergency fund, while long-term goals could involve saving for a home deposit or your children’s education. Clearly defined goals not only provide motivation but also help you prioritise spending and saving. For Australians, tools like the First Home Super Saver Scheme can support property-related savings goals.

Key Tip

Break your goals into actionable steps and set realistic timelines to achieve them.

3. Choose a Budgeting Method

Selecting the right budgeting method is crucial for success. Popular approaches include:

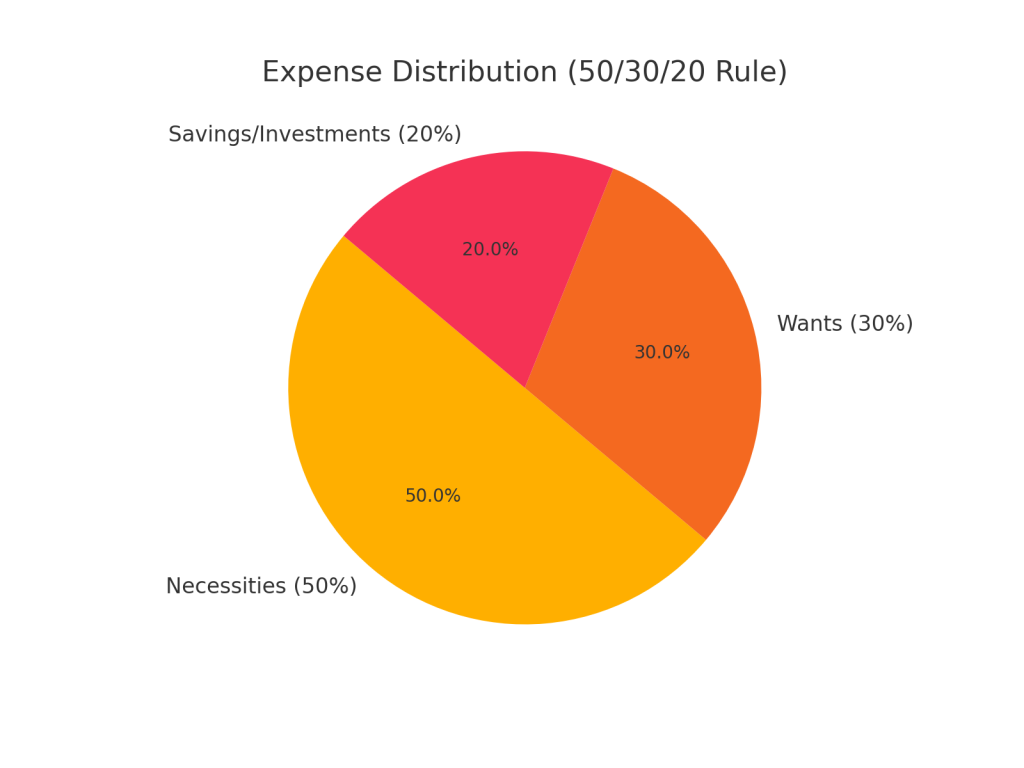

- The 50/30/20 Rule: Allocate 50% of your income to essentials (rent, groceries, utilities), 30% to discretionary spending (entertainment, dining out), and 20% to savings or debt repayment. This method suits those who prefer simplicity.

- Zero-Based Budget: Assign every dollar of your income to a specific purpose, ensuring nothing is left unbudgeted. Ideal for Australians who want precise control over their finances.

- Cash Envelope System: Allocate cash into physical envelopes for categories like groceries, dining, and entertainment. This approach limits overspending and works well for variable expenses.

Key Tip

Experiment with different methods to find what aligns best with your financial habits.

4. Categorise and Track Expenses

Categorising your expenses allows you to see where your money goes. Separate costs into fixed expenses (mortgage, insurance, car payments), variable expenses (groceries, utilities, transport), and discretionary expenses (streaming services, takeout). Use tracking tools like Frollo or the Australian Government’s MoneySmart app to monitor your spending in real time. These tools can also help identify unnecessary expenses that could be trimmed.

Key Tip

Review your bank statements to ensure all recurring expenses are accounted for and evaluate their necessity.

5. Build an Emergency Fund

An emergency fund is a financial safety net that protects you from unexpected expenses like medical bills or car repairs. Aim to save three to six months’ worth of essential expenses. Start small by setting aside a percentage of your income each month. For Australians, consider opening a high-interest savings account with providers like ING or UBank to grow your emergency fund faster.

Key Tip

Automate your savings to ensure consistency without needing to think about it.

6. Optimise Fixed Costs

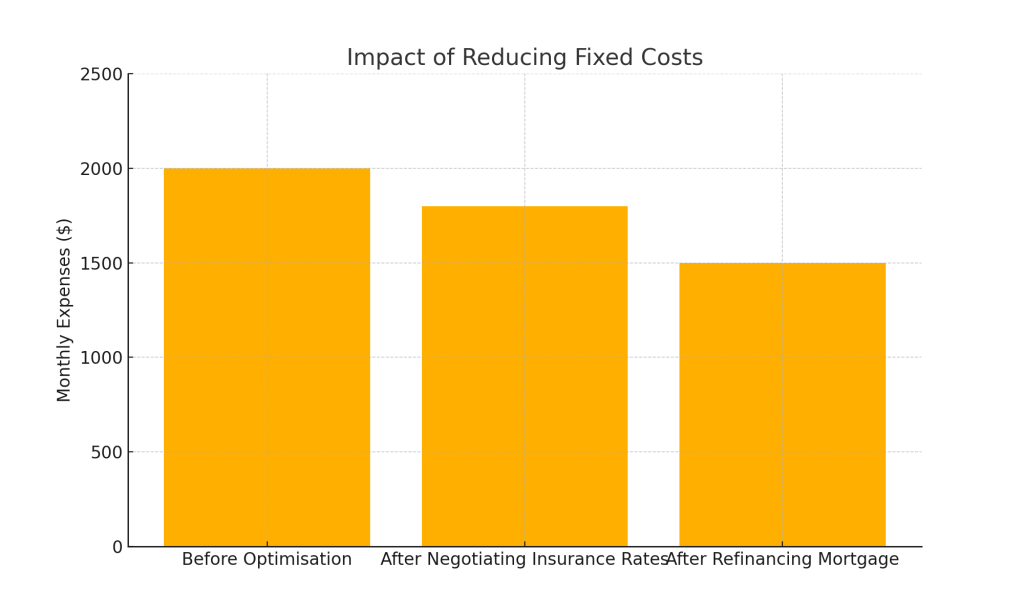

Fixed costs, such as rent or insurance premiums, can often be negotiated or reduced. If you’re renting, consider downsizing or moving to a more affordable suburb. Homeowners can explore refinancing their mortgage to secure a lower interest rate. For insurance policies, use comparison websites like Finder or iSelect to ensure you’re getting the best deal. Many insurers offer discounts for bundling policies or maintaining a claims-free record.

Key Tip

Review fixed costs annually and compare options to ensure you’re not overpaying.

7. Save on Variable Costs

Variable expenses provide significant opportunities for savings. Meal planning and buying in bulk can reduce grocery costs, while using public transport or carpooling can cut travel expenses. For energy savings, switch to LED bulbs, use smart appliances, and consider solar power installations with government rebates available in Australia. Websites like Energy Made Easy help compare utility providers to ensure you’re on the best plan.

Key Tip

Combine multiple saving strategies to maximise impact on variable expenses.

8. Leverage Financial Tools and Apps

Technology can make budgeting easier and more effective. Apps like MoneyHub and Goodbudget are excellent for creating and maintaining a budget. For Australians, tools like the ATO tax calculator can help plan for tax deductions and refunds, which can be incorporated into your savings strategy.

Key Tip

Sync your financial tools with your bank accounts to streamline tracking and updates.

9. Monitor and Adjust Regularly

Budgets are not static; they should evolve with your financial circumstances. Review your budget monthly to assess its effectiveness and make adjustments as needed. Did your expenses increase? Are you saving enough? These reviews will ensure your budget remains relevant and effective. Use the insights gained to set new goals or refine your strategies.

Key Tip

Consider scheduling a dedicated “budget review day” each month to stay consistent.

10. Stay Motivated and Accountable

Sticking to a budget requires discipline and motivation. Share your goals with a trusted friend or partner for accountability. Celebrate small milestones, such as paying off a credit card or reaching a savings target. These rewards keep you motivated and reinforce positive habits.

Key Tip

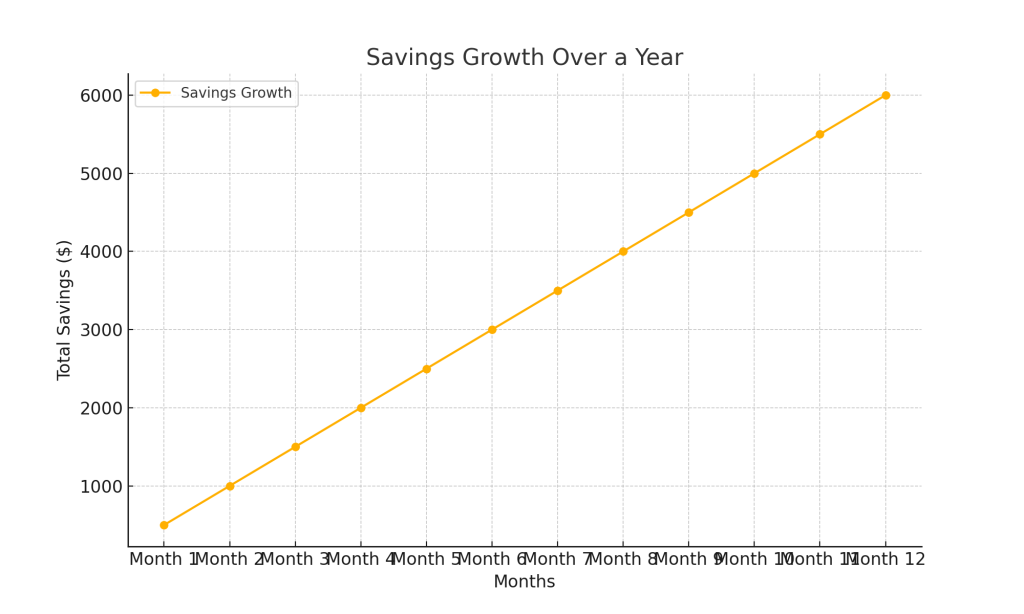

Visualise your progress using charts or apps to track savings growth and debt reduction.

Creating a budget that works for you is not about deprivation—it’s about empowerment. By understanding your financial picture, setting clear goals, and using the right tools and strategies, you can take control of your money and achieve lasting financial stability. In Australia, where the cost of living can be high, these steps provide a practical roadmap to make every dollar count. Start today, and take the first step toward a more secure and fulfilling financial future.